Overview

Forms that are commonly used in Banner 9 Finance System.

Procedures

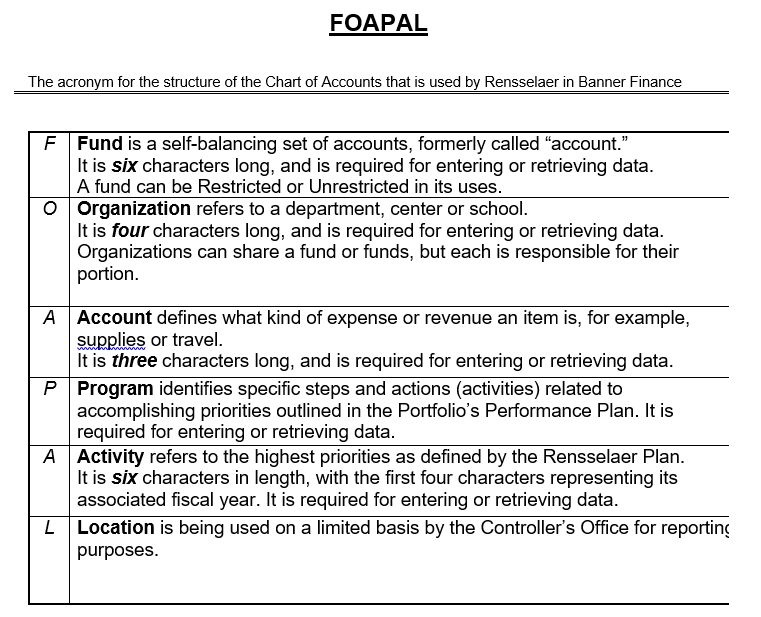

[Table showing the acronyms for the Chart of Accounts used by RPI in Banner Finance]

*** Commonly Used BANNER Finance Forms ***

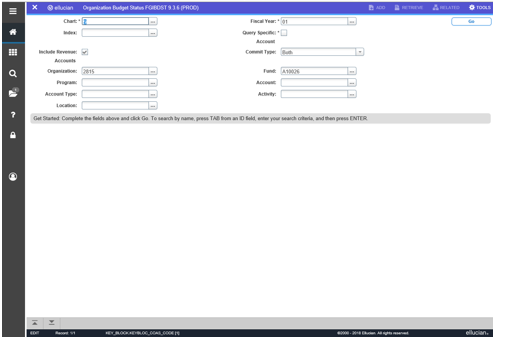

Organization Budget Status Form - FGIBDST

[Window showing the Organization Budget Status Form]

This form is one of the most used forms by those who need information about their Operating Budget. It displays expenses, revenue and encumbrances for a specific fund, and leads to three other very helpful forms.

Organization, Fund: Enter the proper values for the Organization and Fund Codes in these fields. Note: you may need to clear the Program, Account, Account Type, Activity and Location fields in order for BANNER to display all the associated amounts in the detail block.

Include Revenue Accounts: Click to check this box ON to include revenue accounts in the detail block. this checkbox is, by default, CHECKED. When unchecked, an Available Balance will be calculated on the Net Total line.

Revenue account codes are included in the detail block (if INCLUDE REVENUE ACCOUNTS is checked ON) start with 3xx, 4xx and sometimes 5xx.

Activity and Location fields: blank these 2 fields out to broaden scope of search

- Click on the GO button to display the detailed information

[Two windows showing the Organization Budget Status Form showing the Organization, funds, Available Balance, Activity and Location fields, the second window shows the same window but has the Related drop-down menu circled in the upper right corner]

2. Click on any of the forms listed from the Related drop-down menu (upper right corner )for more information:

-

- Budget Summary Information – goes to form, FGIBSUM – the budget summary form

- Organization Encumbrances – goes to form, FGIOENC – which displays all open encumbrances

- Transaction Detail Information – goes to form, FGITRND – which displays all transactions for each account code

- NOTE - Prior to ‘drilling down’ to the next level of transaction detail on the form, FGITRND, note the placement of the cursor in the particular column (Acct, Adj. Budget or YTD Activity) will determine what type of transactions display on the form, FGITRND.

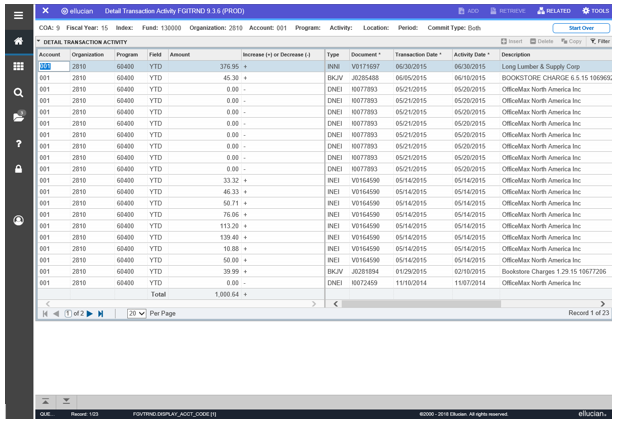

Detail Transaction Activity - FGITRND

This form provides information about the individual transactions within each account code in the operating ledger funds.

This form can be reached directly from any menu by typing FGITRND in the direct access field, or by selecting it from one of the sub-menus, or by clicking the Detail Transaction option line from the ‘Related’ drop-down menu on form FGIBDST. Reaching it from FGIBDST will produce a display like this one; when choosing it directly from the menu, follow this procedure:

- Coming from FGIBDST and clicking on FGITRND from the ‘Related’ drop-down:

[Window showing the Detail Transaction Activity form]

Entity Name/ID Search Form - FTIIDEN

This form displays Vendor/Entity names and their ID numbers.

It is a query form that is usually ‘called’ from other forms using the List Field Values (F9) function. For example, if you press F9 from the Vendor ID Number field in the Requisition Form (FPIREQN), this form will appear, and you will need to Execute a query to find the appropriate entry.

- If searching for Vendors, make sure the Vendors box is checked

[Window showing the Entity Name/ID Search form with the Vendors field checked]

[Window showing the Entity Name/ID Search form with the Vendors field checked and the Last Name field is filled in]

2. Click in the Last Name field (where the name of the vendor is stored). The form will be in query mode. This is, the system expects that you will wish to limit your query by specifying some special criteria.

3.Type the name of the vendor, surrounded by the wildcard character (%). Be aware that the search is case sensitive.

4. Press F8 to execute the query to search for the vendor.

[Window showing the Entity Name/ID Search form with the Active Filter field highlighted]

Vendor History – FAIVNDH

This form provides a listing of all invoices by vendor. It is neither fund nor organization specific.

- Type FAIVNDH in the direct access field; press ENTER

- Enter the vendor code in the Vendor field (click on the Vendor search button to search for the code if needed)

- Enter the appropriate criteria in the Selection box by clicking the drop down arrow and highlighting the selection.

- Click the ‘Go’ button in the upper right corner

[Two windows showing the Vendor History Form showing the Vendor fields filled in, the second window shows the list of Vendors from the search with the Vendor Invoice field highlighted]

From this form, you can navigate to other forms as identified in the ‘Related’ drop-down menu

- View Invoice Information - FAAINVE – Invoice Credit Memo Query form

- Commodity Information - FOICOMM – Commodity Review form

- View Vendor Invoice – FAIVINV – Vendor Invoice Query form

FAIVNDH HINTS:

- Enter and Execute query are available from any of the displayed field columns. When querying in a date field, use DD-MON-YY date format.

- Highlight the line and press the search button (arrow button under the Check Number header) to move to FAICHKH (Check Payment History) form.

- Choose a fiscal year or leave blank to view ALL payments made to the vendor

- The key to finding an invoice is to know the Vendor Invoice Number or the Amount – both fields can be queried

- Check Number: if it begins with a ‘!’, then payment was made by ACH, if it begins with a number, a physical check was created

- Check Date: If this field is blank, then the check or ACH has not occurred yet.

- Due Date: the date the payment is due to happen

- Cancel Indicator: If ‘Y’, then the payment was cancelled.

- For detailed invoice information: Click on the ‘Related’ drop-down menu > View Invoice Information

Document History Form - FOIDOCH

The Document History Form displays the processing history of purchasing and payment documents. It identifies and provides the status of all documents in the processing path for the document you select.

[Window showing the Document History Form]

- Type FOIDOCH in the direct access field; press ENTER

- Enter the document type in the Doc Type field (double click in the doc type field to search for the code, if needed)

- Enter the document number in the Doc Code For example, if the Doc Type = PO, enter the PO number in the Doc Code field.

- Click on the ‘Go’ button. Associated documents relating to the document in the key block will be retrieved.

[Window showing the Document History form with the Document Type field highlighted with a list of documents]

5. For detailed document information, highlight (by selecting) the specific related document. Click on the detailed information option locked on the 'Related' drop-down menu.

- Choose 'Requisition Info' for Requisitions

- Choose 'Query Document' for all other document types.

General Ledger Account Type Hierarchy

|

General Ledger Account Types |

General Ledger Account Type codes and their corresponding descriptions are listed below. The table below also shows the hierarchy of General Ledger Account Types. These are subject to change. |

|

|

|

|

Account Type Code |

Description |

|

10 |

Assets |

|

A1 |

Cash |

|

A2 |

Investments |

|

A3 |

Accounts Receivable |

|

A4 |

Notes Receivable |

|

A5 |

Inventories |

|

A6 |

Prepaid & Other Assets |

|

A7 |

Deposits with Bond Trustees |

|

A8 |

Plant Assets |

|

A9 |

Due To/From Other Funds |

|

AA |

Interfund Borrowings |

|

|

|

|

20 |

Liabilities |

|

L1 |

Liabilities |

|

L2 |

Notes Payable |

|

L3 |

Deposits |

|

L4 |

Deferred Revenue |

|

L5 |

Bonds & Mortgages Payable |

|

|

|

|

30 |

Control Accounts |

|

C1 |

Control Accounts |

|

40 |

Fund Balance |

|

90 |

Fund Additions |

|

95 |

Fund Deductions |

Operating Ledger Account Type Hierarchy

|

Operating Ledger Account Types |

Operating Ledger Account Type codes and their corresponding descriptions are listed below. The table below also shows the hierarchy of Operating Ledger Account Types. These are subject to change. |

|

Account Type Code |

Description |

|

50 |

Revenue |

|

R1 |

Tuition & Student Fees |

|

R2 |

Auxiliary Enterprises |

|

R3 |

Gifts, Grants, & Contracts |

|

R4 |

Investment Income |

|

R5 |

Realized/Unrealized Gains/Losses |

|

R6 |

Interest on Loans |

|

R7 |

Sales & Services of Educational Activities |

|

R9 |

Other |

|

60 |

Labor and Employee Benefits |

|

S1 |

Faculty/Staff Salaries & Wages |

|

S2 |

Employee Benefits |

|

S3 |

Student Wages |

|

S4 |

Miscellaneous Non-Labor Payroll |

|

70 |

Expenditures |

|

EA |

Supplies & Services |

|

EB |

Utilities |

|

EC |

Travel |

|

ED |

Taxes & Insurance |

|

EE |

Telecommunications |

|

EF |

Computer Charges |

|

EG |

Library Materials |

|

EH |

Equipment |

|

EJ |

Internal Billings |

|

EK |

Student Aid |

|

EO |

Other |

|

ER |

Overhead |

|

80 |

Transfers |

|

T1 |

Nonmandatory Transfers |

|

T2 |

Mandatory Transfers |

|

T3 |

Intrafund Transfers |

Fund Type Hierarchy

|

Fund Types |

Fund Type codes and their corresponding descriptions are listed below. The table below also shows the hierarchy of Fund Types. These are subject to change. |

| Fund Type Code |

Description |

|

00 |

Bank Fund |

|

0Z |

Bank Fund |

|

|

|

|

01 |

Current Unrestricted Fund |

|

10 |

Education & General |

|

12 |

Ed & General - Institute Wide |

|

15 |

Designated Fund |

|

|

|

|

02 |

Restricted Fund |

|

A1 |

Sponsored Research |

|

B1 |

Other Sponsored Programs |

|

F1 |

Sponsored Financial Aid |

|

G1 |

Gifts |

|

G5 |

Gifts - Fellowship & Scholarship |

|

H1 |

Research Gifts |

|

H2 |

Non-Research Gifts |

|

H3 |

Gifts with Waived Surcharge |

|

Y1 |

Endowment Income |

|

Y2 |

Separately Invested Income |

|

Z1 |

Quasi Endowment Income |

|

03 |

Auxiliary Enterprises |

|

30 |

Auxiliary Enterprises |

|

31 |

Field House |

|

32 |

Rensselaer Union |

|

33 |

Athletics |

|

34 |

Health Services |

|

35 |

Telecommunications |

|

36 |

Residence Life |

|

04 |

Loan Fund |

|

40 |

Federal Loans |

|

41 |

Non-Federal Loans |

|

42 |

Loan Wire Clearance |

|

|

|

|

05 |

Quasi Endowment Fund |

|

50 |

Quasi-Endow - Restricted Principal |

|

51 |

Quasi Endowment - Unrestricted Principal |

|

52 |

Quasi Endowment - Rensselaer Technology Park |

|

|

|

|

06 |

Endowment Fund |

|

60 |

Endowment - Restricted Principal |

|

61 |

Endowment - Unrestricted Principal |

|

62 |

Endowment - Separately Invested |

|

63 |

Endowment - Pool |

|

|

|

|

07 |

Annuity and Life Income Fund |

|

70 |

Life Income |

|

71 |

Pooled Life Income |

|

72 |

Annuity Funds |

|

73 |

Unitrust Funds |

|

74 |

Lead Trusts |

|

75 |

Other Trusts |

|

08 |

Agency Fund |

|

80 |

Agency Funds |

|

09 |

Unexpended Plant Fund |

|

90 |

Unexpended Plant Fund |

|

29 |

Renewal and Replacement Fund |

|

92 |

Renewal and Replacement Fund |

|

49 |

Retirement of Indebtedness Fund |

|

94 |

Retirement of Indebtedness Fund |

|

69 |

Investment in Plant |

|

96 |

Investment in Plant |

|

Rule Classes |

Rule Classes (transaction types) and their corresponding descriptions are listed below. These are subject to change. |

|

Code |

Description |

|

ABR1 |

Academic Building Repair Vouchers |

|

ACDC |

Cancel Addl Charges on Credit Memo |

|

ACDI |

Cancel Addl Charges on Invoice |

|

ACEC |

Cancel Addl Chrg on C/M w/ Encumb |

|

ACEI |

Cancel Addl Chrg on Inv w/Encumb |

|

ACII |

Cancel Addl Chrgs on Inv w/G/L Acct |

|

ACIP |

Auto Construction in Progress |

|

ADDI |

Additional Charges on an Invoice |

|

ADEC |

Addl Chrg on Credit Memo w/ Encumb |

|

ADEI |

Addl Charges on Invoice w/Encumb |

|

ADII |

Addl Charges on Invoice w/G/L Acct |

|

ADJC |

Adjustment to Inventory Value |

|

ADJE |

Audit Adjustment – Unbalanced |

|

ADJV |

Audit Adjustment Journal Entry |

|

ADPR |

Adjust depreciation(up or down) |

|

ADTR |

Audit Adj Transfer Journal Entry |

|

AIS1 |

AIS Misc Charges |

|

AL01 |

ProAlloc for perm. adopt budget |

|

AL02 |

ProAlloc for perm. adj budget |

|

AL04 |

ProAlloc. for encumbrance |

|

AL05 |

ProAlloc. for budget reservation |

|

ALE3 |

ProAlloc for year to data actv |

|

ALR3 |

ProAlloc. for year to date revenue |

|

APH1 |

Banner Student - APPL CHG – Diff |

|

APH2 |

Banner - APPL CHG – Diff |

|

APH3 |

Banner Student - APPL CSH – Like |

|

APH4 |

Banner Student - APPL CSH – Diff |

|

APH5 |

Banner Student APPL CHG – Diff |

|

APH6 |

BannerStudent - APPL CHG – Diff |

|

APH7 |

Banner Student - APPL CSH – Like |

|

APH8 |

Banner Student - APPL CSH – Diff |

|

APL1 |

Banner Student - APPL CHG-Like |

|

APL2 |

Banner Student - APPL CHG – Diff |

|

APL3 |

Banner Student - APPL CSH – Like |

|

APL4 |

Banner Student - APPL CSH - Diff |

|

APS1 |

Banner Student - APPL CHG-Like |

|

APS2 |

Banner Student - APPL CHG - Diff |

|

APS3 |

Banner Student - APPL CSH - Like |

|

APS4 |

Banner Student - APPL CSH - Diff |

|

APWH |

Application of AR Pymt,Withholding |

|

ASCR |

Cash Receipt-Adv Services |

|

ASCS |

Banner Alumni Cash Receipt |

|

ASDE |

Banner Alumni Gift (Payroll Deduct) |

|

ASJV |

Journal Voucher |

|

ASLN |

Banner Alumni Gift of Land/Property |

|

ASMS |

Academic Support and Media Services |

|

AUDT |

Audit Adjustments - Fin Rptg |

|

BD01 |

Permanent Adopted Budget |

|

BD02 |

Permanent Budget Adjustments |

|

BD03 |

Temporary Adopted Budget |

|

BD04 |

Temporary Budget Adjustment |

|

BD10 |

Budget Development Request |

|

BD14 |

Budget Off Temporary Bdgt Adjustmnt |

|

BDRT |

Budget for Revenues and Transfers |

|

BFOP |

Balance Forward Operating Ledger |

|

BFRV |

Reverse Balance Forward |

|

BILE |

Bill Expense Acct w/enc in Cost Act |

|

BILI |

Bill Income Acct in Cost Accounting |

|

BILL |

Bill Cost Acctg. Job, no encumbranc |

|

BKCR |

Renss Union Bus Ops Cash Receipts |

|

BKJV |

Bookstore Charges |

|

BKMV |

Renss Union Bus Op Cash Receipt M/V |

|

BOA1 |

Banner Student Receipt Cash BoA |

|

BOAC |

Banner Student Cash Clearing BoA |

|

BRS1 |

Billing and Receivable BRS |

|

BT01 |

Biotech Analytical Core Charge |

|

BT02 |

Biotech Proteomics Core Charge |

|

BT03 |

Biotech Microscopy/Imaging Core Chg |

|

BT04 |

Biotech Microbiology Core Charge |

|

BT05 |

Biotech Core NMR 600 Charge |

|

BT06 |

Biotech Core NMR 800 Charge |

|

BT07 |

Biotech Cell & Molecular Core Chrg |

|

BT08 |

BioResearch Core Charge |

|

BT09 |

Biotech MRI Core Charge |

|

BUD1 |

Permanent Budget Adjustments – SYSO |

|

BUD2 |

Permanent Budget Adjustments – SYSO |

|

BURS |

Bursar Office Journal Entry |

|

BW01 |

DNNI Clone for Journal Vouchers |

|

BW02 |

CNNI Clone for Journal Vouchers |

|

BW03 |

INNI Clone for Journal Vouchers |

|

BW04 |

ICNI Clone for Journal Vouchers |

|

BW05 |

1 Sided P/R Deductions Corrections |

|

BW06 |

Correct Unbalanced Entries |

|

BW08 |

Update P/Y Rev/FB |

|

BW09 |

Correct GL Update |

|

CAEC |

Cancel Check C/M Addl w/Encumb |

|

CAEI |

Cancel check invoice addl w/encumb |

|

CAII |

Cancel Check Invtry Invoice Taxes |

|

CAXC |

Cancel Check - C/M tax |

|

CAXI |

Cancel Check - Invoice tax |

|

CC01 |

Interchart Credits |

|

CC77 |

Currency Conversion Code Validation |

|

CCRD |

Credit Card Purchase Charges |

|

CD01 |

Interchart Charges |

|

CDDC |

Cancel Check C/M addl chgs |

|

CDDI |

Cancel check invoice addl charges |

|

CDEC |

Cancel check C/M disc w/emcumb |

|

CDEI |

Cancel Check Invoice disc w/encumb |

|

CDII |

Cancel Check Invtry Inv Addl Chrgs |

|

CDWI |

Federal Witholding on Cancel Check |

|

CHEM |

Chemistry Department Charges |

|

CHG1 |

Banner Student Charges - #1 |

|

CHG2 |

Banner Student Charges - #2 |

|

CHH1 |

Banner Student Charges - #1 |

|

CHH2 |

Banner Student Charge – Refund |

|

CHH3 |

Banner Student Charges - #1 |

|

CHS1 |

Banner Student Charges - #1 |

|

CHS2 |

Banner Student Charge – Refund |

|

CICG |

Computer Graphics |

|

CIIC |

Cancel Check Inv Valuation Adj |

|

CIII |

Cancel Check Inventory Inv Discount |

|

CISC |

Cancel Check - C/M discount |

|

CISI |

Cancel Check - Invoice discount |

|

CNEC |

Cancel Check - C/M w encumbrance |

|

CNEI |

Cancel Check - Invoice w encumbrance |

|

CNEP |

Cancel Check CY, Invoice w/encum PY |

|

CNII |

Cancel Check Inventory Invoice |

|

CNNC |

Cancel check - C/M w/o encumbrance |

|

CNNI |

Cancel Check - Invoice w/o encumb |

|

COAD |

Additional Charge on Change Order |

|

CODS |

Discount on Change Order |

|

CONT |

Continuing Ed Deposits |

|

CORD |

Establish Change Order |

|

COTH |

Cash - Other Miscellaneous Transact |

|

COTX |

Tax on Change Order |

|

CR01 |

Cashier's Cash Receipt $ |

|

CR02 |

Cashier's Cash Receipt MC/V |

|

CR03 |

Cash Receipt - Advanced Funds |

|

CR05 |

Cash Receipt Entry |

|

CR07 |

Cash Receipt Entry Bursar Office |

|

CRC1 |

Cash System |

|

CRPC |

VCC Cash Receipt |

|

CSEC |

Cash - Security Purchase or Sale |

|

CSH1 |

Banner Student - Receipt – Cash |

|

CSH2 |

Banner Student - Cash Receipt Check |

|

CSHC |

Banner Student - Cash Clearing |

|

CSS1 |

Banner Student - Receipt – Cash |

|

CSS2 |

Banner Student Receipt - Credit Crd |

|

CSS3 |

Banner Student Receipt Sallie Mae |

|

CSS4 |

Banner Student Receipt |

|

CSSC |

Banner Student - Cash Clearing |

|

CTEC |

Can Chk-NonVend Tx CM w/encumbrance |

|

|

|

|

CTEI |

Cancel tax for CXEI |

|

CTII |

Cancel non-vend-tax for checks |

|

CTWI |

State Witholding on Cancel Check |

|

CTXC |

Cancel tax w/CAXC |

|

CTXI |

Cancel tax for CAXI |

|

CXEC |

Cancel check C/M tax w/encumnb |

|

CXEI |

Cancel check invoice tax w/encumb |

|

CZDS |

Cash Zero Bal Transfer Disbursement |

|

CZPR |

Cash Zero Bal Transfer to Payroll |

|

DAEC |

Check C/M Addl w/Encumb |

|

DAEI |

Check invoice Add'l Chgs/encumb |

|

DAII |

Check - Inventory Invoice Tax |

|

DAKA |

DAKA |

|

DAXC |

Check - C/M tax |

|

DAXI |

Check - Invoice tax |

|

DAXL |

Exchange adjustment for TAXL |

|

DAXX |

Exchange Adjustment for TAXX |

|

DCEC |

Cancel Discount on C/M w/ Encumb |

|

DCEI |

Cancel Discount on Inv w/ Encumb |

|

DCII |

Cancel Discount on Inv w/G/L Acct |

|

DCSC |

Cancel Discount on Credit Memo |

|

DCSI |

Cancel Discount on Invoice |

|

DCSR |

Direct Cash receipt |

|

DDDC |

Check - C/M addl charges |

|

DDDI |

Check invoice addl charges |

|

DDEC |

Check - C/M - Disc w/encumb |

|

DDEI |

Check invoice discount w/Encumb |

|

DDII |

Check - Inventory Invoice Addl Chrg |

|

DDSC |

Check - C/M discount |

|

DDSI |

Check - Invoice Discount |

|

DDWI |

Record Federal Witholding on Check |

|

DEPP |

Recording past depreciation |

|

DEPR |

DEPRECIATION RULE CLASS |

|

DIEC |

Discount on Credit Memo |

|

DIEI |

Discount on Invoice w/ Encumb |

|

DIIC |

Check - Inventory Invoice Discount |

|

DIII |

Discount on Invoice w/G/L Acct |

|

Code |

Description |

|

DISB |

Disbursements Journal Entry |

|

DISC |

Discount on Credit Memo |

|

DISI |

Discount on Invoice |

|

DISN |

Disposal without depreciation |

|

DISP |

Disposal of asset with depreciation |

|

DISR |

Disposal: Sharing of revenue |

|

DNEC |

Check - C/M w encumbrance |

|

DNEI |

Check - Invoice w encumbrance |

|

DNII |

Check - Inventory Invoice |

|

DNNC |

Check - C/M w/o encumbrance |

|

DNNI |

Check - Invoice w/o encumb |

|

DSCA |

Cash Disbursement - CM Addl Charge |

|

DSCD |

Cash Disbursement - CM Discount |

|

DSCI |

Cash Disbursment - Credit Memo |

|

DTWI |

State Witholding on Check |

|

DXEC |

Check - C/M tax w/encumb |

|

DXEI |

Check invoice tax w/encumb |

|

E010 |

Post Original Encumbrance |

|

E020 |

Encumbrance Adjustment |

|

E032 |

Encumbrance Liquidation |

|

E037 |

Encumbrance Liq. allow changes |

|

E044 |

RPI Troy General Encumbrance |

|

E046 |

RPI Troy Encumbrance Adjustment |

|

E048 |

RPI Troy Encumbrance Liquidation |

|

E090 |

Year End Encumbrance Roll |

|

E095 |

Commits a Encumbrance(prev. rolled) |

|

E100 |

Original Encumbrance |

|

ED01 |

Distribute Earnings |

|

END1 |

Endowment |

|

END2 |

Endowment Operations Journal Entry |

|

ER01 |

Record Earnings |

|

ETRF |

Endowment Transfer Journal Entry |

|

FBEN |

Reallocation - Fringe Benefits |

|

FC01 |

Interfund Credits |

|

FD01 |

Interfund Charges |

|

FINR |

Financial Reporting JV Rule |

|

FPW0 |

Work Order |

|

FPWO |

Work Orders |

|

FSI1 |

Stockroom Inventory |

|

FT01 |

Interfund Transfer |

|

FTRF |

Financial Rptg Trsfr Journal Entry |

|

GCJV |

Campus General Journal Entry |

|

GFA1 |

Graduate Financial Aid |

|

GFA2 |

Graduate Financial Aid Journal Entry |

|

GLAS |

Change asset account for fixed asset |

|

GLCE |

Change Cap. Fund/equity/asset |

|

GLCF |

change cap fund for fixed asset. |

|

GLEQ |

Change equity account |

|

GLFE |

Change cap fund and equity account |

|

GLRE |

Reverse old fund/equity/asset |

|

GRAP |

Grant Application of Payment |

|

GRAR |

Accrued Accounts Receivable |

|

GRBL |

Billed Accounts receivable |

|

GRCC |

Grant - Cost Share Charge |

|

GRCG |

Grant - Cost Share Grant |

|

GRDF |

Deferred Revenue |

|

GRIC |

Grant - Indirect Cost Charge |

|

GRIR |

Grant - Indirect Cost Recovery |

|

GRPM |

Grant Payment |

|

GRRF |

Grant Refund |

|

GRRV |

Grant - Accrued Revenue |

|

GRTF |

Grant Payment Transfer |

|

GRWH |

Withholding accounts receivable |

|

HB10 |

Budget Development Request |

|

HCBA |

Payroll - COBRA - Admin. Fee |

|

HCBC |

Payroll - Cobra Cash Receipt |

|

HCBP |

Payroll - COBRA - Premium |

|

HCS1 |

Banner Student - Receipt - Cash |

|

HCS2 |

Banner Student Receipt - Cash |

|

HDEF |

Payroll - Deferred Pay |

|

HDPA |

Payroll - Deferred Pay Accrual |

|

HEEL |

Payroll - Employee Liability |

|

HEMP |

Payroll - Employr Expense/Liability |

|

HENA |

Payroll - Encumbrance Adjustment |

|

HENC |

Payroll - Salary Encumbrance |

|

HERL |

Payroll - Employer Liability |

|

HFEA |

Payroll - Fringe Benefit Enc. Adj. |

|

HFEN |

Payroll - Fringe Benefit Encumb. |

|

HFEX |

Payroll - Actual Fringe Ben. Dist. |

|

HFNL |

Payroll - Fringe Chargeback w/o Liq |

|

HFRC |

Payroll- Fringe Chargeback Clearing |

|

HFRD |

Payroll - Fringe Chargeback w/Liq |

|

HGNL |

Payroll - Gross Exp. No Liquidation |

|

HGRB |

Payroll - Gross Benefit Expense |

|

HGRS |

Payroll - Gross Salary Expense |

|

HNET |

Payroll - Net Pay |

|

HRJV |

Troy Human Resources Journal Entry |

|

HSBC |

Banner Student Cash Clearing HSBC |

|

HSSC |

Banner Student - Wires and Cr Cards |

|

ICEC |

Cancel Credit Memo w/ Encumbrance |

|

ICEI |

Cancel Invoice with Encumbrance |

|

ICEP |

Cancel Invoice with Encumbrance |

|

ICER |

Cancel Credit Memo w/ Enc - PY |

|

ICII |

Cancel Inv w/G/L Account no Enc |

|

ICNC |

Cancel Credit Memo w/o Encumbrance |

|

ICNI |

Cancel Invoice without Encumbrance |

|

IIIC |

Invoice Cancel - Valuation Adjust |

|

IIII |

Invoice - Valuation Adjustment |

|

IMS1 |

Instrumentation Media Services Chg |

|

IMS2 |

Electronic Stockroom Chgs |

|

IMS3 |

Graphics Productions - IMS Chg |

|

INCN |

Reallocation - Research Incentive |

|

|

|

|

INCR |

Incubator Ctr - Cash Receipts |

|

INEC |

Credit Memo with Encumbrance |

|

INEI |

Invoice with Encumbrance |

|

INEP |

Invoice with Encumbrance charged PY |

|

INER |

Credit Memo with Encumbrance PY |

|

INII |

Invoice w/G/L Account no Enc |

|

INNC |

Credit Memo without Encumbrance |

|

INNI |

Invoice without Encumbrance |

|

INVC |

Invoice Rule Class |

|

IPNC |

Zero Payment Credit Memo |

|

IPNI |

Zero Payment Invoice |

|

IR01 |

Record Investment |

|

ISCP |

Return Profit Invtry Acct |

|

ISEC |

Request Return |

|

ISEU |

Request Issue |

|

ISIC |

Return Item Invtry Acct |

|

ISIU |

Issue Item Invntry Acct |

|

ISSC |

Return (No Request) |

|

ISSU |

Direct Issue (No Request) |

|

ISUP |

Issue Profit Item Invtry Acct |

|

IT01 |

ITS Misc Charges |

|

ITBS |

ITS Telephone Billing System |

|

ITCS |

ITS Computer Supplies |

|

ITCU |

ITS Computer Usage |

|

ITEQ |

ITS Equipment Repair |

|

ITMC |

ITS Mini Courses |

|

ITMS |

ITS Miscellaneous Charges |

|

ITPC |

ITS PC Repair |

|

J001 |

General Ledger Closing Journal |

|

J010 |

Encumbrance Carry Forward Journal |

|

J020 |

Budget Carry Forward Journal |

|

J099 |

Interfund Cash Transfer Entry |

|

JCDE |

Cont/Dist Ed Journal Voucher |

|

JE05 |

General Ledger Beginning Balance |

|

JE10 |

Accounts Receivable Entry |

|

JE15 |

General Journal Entry |

|

|

|

|

JE25 |

Interchart Journal Entry |

|

KYSH |

Keyshop Charges |

|

LBOX |

Lockbox Transactions |

|

LIB1 |

Library Photocopy Charges |

|

LIB2 |

Library Interlibrary Loan Charge |

|

LIB3 |

Library - Cash Receipts |

|

LIB4 |

Library JV - Misc Charges |

|

LOAN |

Student Loan Office Misc Disb/Recpt |

|

|

Mailroom |

|

MCRD |

Banner Student - MC Receipts |

|

MDCD |

Executive Medical Card Charges |

|

MIP1 |

Monthly Installement Plan |

|

MISC |

Banner AR - TFAMISC Default Rule |

|

MLR1 |

Mailroom Misc Charges |

|

MSCR |

Academic Supp/Media Svc Cash Receip |

|

N001 |

Endowmnt Spndble Interfund Transfer |

|

N002 |

Endwmnt Rlz. Gn/Ls Interfund |

|

N003 |

Endwmnt URlz. Gn/Ls Interfund Trans |

|

N004 |

Endowmnt Spnd. Var. Interfund |

|

NOOP |

No operation |

|

NSI1 |

Non-Stock Inventory |

|

NST1 |

Inventory, Non-Stock |

|

OAEC |

Offset C/M Addl w/encumb |

|

ODWI |

Federal Withholding on Offset |

|

OTWI |

State Withholding on offset |

|

PA05 |

Payroll Disbursement |

|

PA06 |

Payroll Disbursement |

|

PBD1 |

Permanent Adopted Budget - Plant |

|

PBD2 |

Permanent Budget Adjustments-Plant |

|

PBD9 |

Plant Transfer with CIP Bdgt Update |

|

PC01 |

Product Center |

|

PCAD |

Cancel Add'l Chrg on Purchase Order |

|

PCAP |

Cancel Addl Chg on Purchase Order PY |

|

PCDP |

Cancel Disc on Purchase Order Prior Y |

|

PCDS |

Cancel Discount on Purchase Order |

|

PCLQ |

Cancel PO - Reinstate Request |

|

PCMS |

Product Center - Miscellaneous Chgs |

|

PCRD |

Cancel Purchase Order |

|

PCRP |

Cancel Purchase Order in Prior Year |

|

PCSH |

Petty Cash Transaction - Cashier |

|

PCTP |

Cancel Tax on Purchase Order Prior YR |

|

PCTX |

Cancel Tax on Purchase Order |

|

PLIB |

Purchase Card Liability |

|

PLNT |

Plant Fund Operations Journal Entry |

|

POAD |

Additional Charge on Purchase Order |

|

POAP |

Addl Chg on Purchase Order Prior YR |

|

POBC |

Purchase Order Batch Close |

|

POCL |

Purchase Order Close (FPAEOCD) |

|

PODP |

Disc on Purchase Order Prior Year |

|

PODS |

Discount on Purchase Order |

|

POLQ |

Purchase Order-Request Liquidation |

|

POPN |

Purchase Order Open (FPAEOCD) |

|

PORD |

Establish Purchase Order |

|

PORP |

Estab Purchase Order in Prior Year |

|

POTP |

Tax on Purchase Order Prior Year |

|

POTX |

Tax on Purchase Order |

|

PR01 |

HEEL Clone - Unposted PR Ded |

|

PR02 |

Unposted Labor Exp - HGRS |

|

PR03 |

Unposted Labor Exp - HGRS |

|

PR04 |

O030 only Entry/Adj |

|

PROJ |

Project Encumbrance |

|

PTRF |

Plant Operations Transfer J Entry |

|

RBD1 |

Research Permanent Adopted Budget |

|

RBD2 |

Research Permanent Budget Adjustment |

|

RBD3 |

Research Temporary Adopted Budget |

|

RBD4 |

Research Temporary Budget Adjustment |

|

RBTR |

Return rebate on cash receipt |

|

RCJV |

Campus Research Journal Entry |

|

RCQA |

Cancel Add'l Charge on Requisition |

|

RCQD |

Cancel Discount on Requisition |

|

RCQP |

Cancel Requisition |

|

RCQX |

Cancel Tax on Requisition |

|

RCSH |

Research Cash Receipt - NO A/R |

|

RCVD |

Receiving Stock |

|

|

|

|

REBC |

Credit Memo - Rebate Tax |

|

REBD |

rebate exchange difference |

|

REBT |

Tax Rebate |

|

REBX |

Tax Rebate Cancellation |

|

REF1 |

Banner Student - Refund Rule |

|

REH1 |

Banner Student - Refund Rule |

|

REQA |

Additional Charge on Requisition |

|

REQD |

Discount on Requisition |

|

REQP |

Requisition - Reservation |

|

REQR |

Req - Reservation Adjustment RPI |

|

REQS |

Stores Requisition |

|

REQX |

Tax on Requisition |

|

RES1 |

Banner Student - Refund Rule |

|

RQCL |

Requisition close (FPAEOCD) |

|

RSCH |

Research Accounting Journal Entry |

|

RST1 |

Banner Student - Travel Refund |

|

RSVP |

RSVP Cash Receipt |

|

RTCK |

Return Check Entry Code |

|

RTRF |

Research Transfer Journal Entry |

|

RUCR |

Renss Union Clubs - Cash Receipts |

|

RUJV |

Renss Union Clubs Charges |

|

RUTF |

Rensselaer Union Transfers |

|

RWIR |

Research Wire Receipt |

|

SCAO |

Capitalization of origination tags. |

|

SCAP |

Subsequent capitalization for asset |

|

SENG |

School of Engineering Journal Entry |

|

SIS1 |

SIS Cash Receipt - MC/V |

|

STPY |

Stop Payment-Reissue Check |

|

SYSO |

System Operations Journal Entry |

|

TAEC |

Sales Tax on Credit Memo w/ Encumb |

|

TAEI |

Sales Tax on Invoice w/ Encumb |

|

TAII |

Sales Tax on Invoice w/G/L Acct |

|

TAXC |

Sales Tax on Credit Memo |

|

TAXI |

Sales Tax on Invoice |

|

TAXL |

Record Liability for Non-vendor Tax |

|

TAXR |

Remove tax liability on Cash Receipt |

|

TAXX |

Cancel Liability for Non-Vendor Tax |

| TBS1 |

Student Telephone Billing |

|

TC01 |

Tellers Cash Entry |

|

TCEC |

Cancel Sales Tax on C/M w/ Encumb |

|

TCEI |

Cancel Sales Tax on Inv w/ Encumb |

|

TCII |

Cancel Sales Tax on Inv w/G/L Acct |

|

TCRD |

Travel Card Charges |

|

TCXC |

Cancel Sales Tax on Credit Memo |

|

TCXI |

Cancel Sales Tax on Invoice |

|

TEMP |

Temp RUCL Used to Fix DNNI Post Bug |

|

TGCR |

Training Cash Receipt |

|

TGJV |

Training Journal Entry |

|

TLC1 |

Telecom |

|

TLC2 |

Telecommunication Charges |

|

TRNF |

Stores Inventory Transfer |

|

TRSF |

Transfer Journal Entry |

|

VISA |

Banner Student - Visa Receipts |

|

WOFD |

Writeoff with depreciation |

|

WOFF |

Write off without depreciation |

|

WRID |

Write down with depreciation |

|

WRIN |

Bank Wire Transfer In |

|

WRIT |

Write adjustments(down or up) |

|

WROT |

Bank Wire Transfer Out |

|

YECL |

Year-End Close Operating Accounts |

|

YR10 |

Fiscal Year End Cash Disbursement |

|

YR20 |

Fiscal Year End Cash Receipt |

Glossary

|

Account |

A category of cost or revenue activity. Accounts are used to break down and help describe financial activity. BANNER accounts are designated by a unique code and corresponding name. However, different organizations or funds may charge to the same account code. For example, both organization code 1234, Department of Creative Finance, and organization code 5678, Department of Redundancy Department, might charge to account code 203, Adjunct Faculty Salary.

|

|

Account Index |

A code that linked elements of the FOAPAL code to the previous accounting system.

|

|

Account Query Type |

A code indicating the type of query. Valid values are R and S: R indicates that the query you are entering is “relative.” This means the form will display everything matching the account code you enter in the Key Block plus information from all subsequent accounts. For example, if you enter a relative query on account code 241, the resulting form will include information from account 241 on through the end of the account list. S indicates that your query is “specific.” The form will display only the information that exactly matches the account code you enter in the Key Block. For example, if you enter a specific query on account code 241, the resulting form includes only information from account 241.

|

|

Account Type |

Summary levels of accounts. Some common account types include revenue, labor, direct expenditures, and transfers.

|

|

Activity |

Required field for entering or retrieving data from Banner. Represents the 1st year highest priorities as defined by the Rensselaer Plan.

|

| Available Balance |

An amount calculated on many forms and reports, indicating the amount of budget still available for the current fiscal year.

|

|

BANNER |

Oracle-based software systems for information management, sold by Systems Computer Technologies (SCT). Rensselaer uses three major products within the BANNER series: the Financial system, the Human Resources system and the Student system.

|

|

Benefit Rate |

See Employee Benefit Rate.

|

|

Budget |

The spending plan for an annual allocation or a project.

|

|

Budget Reservation |

Money that has been set aside for spending, but not actually paid out yet. The budget reservation amount shown on reports and forms includes dollars committed on reservations and encumbrances, like requisitions and purchase orders that have not yet been paid.

|

|

Chart of Accounts (COAS) |

The Chart of Accounts (COAS) is the most encompassing financial category in BANNER. That is, it is the top level of the BANNER financial hierarchy. Information in the COAS includes the “FOAPAL”: all fund, organization, account, program, activity, and location (location is not in use) information underneath it. (See also FOAPAL.)

Currently, Rensselaer uses 1 COAS, designated by the number 9 for Troy. .

|

|

Committed Funds |

Funds reserved or encumbered for spending but not yet spent.

|

|

Current Fiscal Period |

The fiscal period through the month indicated in the as-of date on the form or report. See fiscal period.

|

|

Current Period Activity

|

Transaction details for the current month. |

|

Defaulting |

A timesaving feature for data input in BANNER forms, where entry of one FOAPAL element brings several associated elements to the screen. For example, if you enter an organization code, a corresponding fund code is displayed.

|

|

Direct Expenditures |

Expenditures exclusive of labor, employee benefits, and transfers.

|

|

Document |

A unique record or set of records; for example, a purchase order or journal voucher.

|

|

Document Code |

A unique identifying code assigned to the individual document (sometimes called the document number). Every requisition has a requisition code; every purchase order has a purchase order code; etc.

|

|

Document Number |

See Document Code.

|

|

Document Type |

A classification of documents, indicated by a document type code. Common document types are REQ for requisitions; PO for purchase orders; INV for invoices; and CHK for checks.

|

|

Employee Benefit Rate |

The rate at which an organization or fund is charged for employee benefit costs.

|

|

Encumbrance |

See Committed Funds.

|

|

Expenditures |

Funds that have been spent.

|

|

BANNER Forms |

See Form.

|

|

BANNER Functions |

On-line operations, which allow system users to navigate on-line forms and information. Functions exist for many on-line navigational tasks, including cursor movement, data inquiries, data entry, and accessing forms.

|

|

Financial Manager |

The individual with financial responsibility for the fund or organization. (There are fund financial managers, and organization financial managers.) This individual is authorized to spend from and receive money into the fund or organization. In some cases, the fund and organization financial manager is the same person (for example, a department head who is conducting his or her own research).

|

|

Fiscal Period |

In BANNER, a fiscal period is one month. The first period of the fiscal year is July, since the Rensselaer fiscal year begins on July 1. In some reports and forms, you will see a number designating the fiscal period. The number 1 designates the first fiscal period (July); the number 2 designates the second fiscal period (August); 3 designates September, and so on.

|

|

Fiscal Year |

The Rensselaer fiscal year runs from July 1 through the following June 30. |

|

FOAPAL |

An acronym identifying the six elements of the Chart of Accounts accounting codes. These six elements are as follows: Fund Organization Account Program Activity Location

|

|

Form |

The on-line (screen) presentation of BANNER information.

|

|

Function Keys |

A key or a combination of keystrokes, that you can press to enter certain commands while working in BANNER forms (rather than entering a string of text for the command).

|

|

Fund |

An accounting entity with a self-balancing set of accounts consisting of assets, liabilities, and a fund balance. Separate funds are maintained to insure observance of limitations and restrictions placed on use of resources. Funds are grouped into fund types, which classify resources according to their various purposes. An example of a fund might be a research project for which a researcher or group of researchers from one or many departments receive financial support. Along with research funds, other funds include auxiliary funds, gift funds, grant funds, and plants funds. In BANNER, each fund has a unique identifying code and name. (See also Fund Type, Organization, Committed Funds, and Uncommitted Funds.)

|

|

Fund Financial Manager |

See Financial Manager.

|

|

Fund Type |

A category of financial activity, used to classify money from a particular source or for a particular purpose. In the BANNER hierarchy, fund types are large categories of financial activity often broken down into funds and/or organizations. (See Organization.) There are six basic fund types: unrestricted, restricted, plant, loan, endowment, and designated. Each fund type has a unique fund type code and corresponding name.

|

Grant |

A grant is funding received from external sources via an award document (such as a contract, a PO, or a letter of agreement), supporting research or other sponsored programs. A grant is accounted for by a fund or a group of funds, to ensure compliance with sponsor requirements and to provide reporting to the funding source.

|

|

Hierarchy |

BANNER’s structural arrangement allowing summary-level groupings (sometimes called “roll-ups”) of organizations and funds. This hierarchical accounting structure allows you to roll up the lower-level organizations or funds into the summary levels for reporting and accounting purposes. For example, several single organizations (including the Department of Philosophy, the Department of Language, Literature, and Communication, and other Departments and offices) can be grouped into the summary-level organization of the School of Humanities and Social Sciences for reporting purposes.

|

|

Index |

See Account Index.

|

|

IIT |

Limited PO - Invoice document code prefix.

|

|

Labor |

Expenditures for salaries and wages.

|

|

Liquidating Amount |

Payments or reductions of an original amount.

|

|

Location |

A FOAPAL element; not in use.

|

|

Net |

The amount calculated as follows: revenue - (expenditures + transfers).

|

|

NSF Checking |

Non-sufficient fund checking. |

|

Organization |

A category of financial activity. Organizations correspond to the operating units of the Institute. At Rensselaer, some organizations are departments (like Economics and Mathematics), some are centers, and some are specific administrative units (like Payroll). In BANNER, each organization has a unique identifying code and name.

|

|

Organization Financial Manager

|

See Financial Manager. |

|

Period |

See Fiscal Period.

|

|

Position |

Each organization is authorized by the Institute to have some specific number of positions (jobs). Each position is assigned a position code as a unique identifier. The position code identifies the type of position; for example, secretary, groundskeeper, professor, etc. An employee may be assigned to more than one position code within an organization.

There are positions defined to accommodate groups of like employees. These are known as “pooled” positions. For example, STUDENTS can be assigned to any of the following pooled positions:

Graduate student tuition is also processed through a “pooled” position.

|

|

Predecessor Organization |

A predecessor organization is a summary level of organizations. That is, several organizations at the lowest level in the BANNER hierarchy can be grouped into a single predecessor organization one level higher in the hierarchy. Predecessor organizations are used for summary-level reporting.

|

|

Project To Date |

The time period beginning with a project’s beginning date and extending through the current or as-of date.

|

|

Reservation |

Funds that have been set aside to be spent by processing a purchase requisition but have not yet actually been spent.

|

|

Revenue |

Income.

|

|

Rule Class Code |

See Transaction Type.

|

|

Suffix |

A subset of position. It is used primarily by payroll, because an employee can have multiple jobs or appointments within a position. For example, a faculty member may have an academic appointment and a summer appointment.

|

|

Transaction Type |

A code identifying the type of transaction. Also known as the rule class code of the transaction.

|

|

Year-to-Date (YTD) Activity |

Financial activity from July 1 (the beginning of the fiscal year) through the month reflected in the as-of date. |

Comments

0 comments

Article is closed for comments.